Gold, Silver Rise 2.5% and 3.2% As ‘Trump Trade’ Fades

Gold and silver jumped another 1% overnight in Asia, building on the respective 1.5% and 2.2% gains seen last week. The 'Trump trade' is fading, impacting stock markets and risk off has returned to global markets with the Nikkei, S&P 500 futures and European stocks weakening.

The precious metals had their second consecutive week of gains last week. Gold rose 1.5% and silver 2% while platinum rose 0.5% and palladium surged 4.8%. Today, gold has risen from $1,247.90 to a one month high of $1,259 per ounce and silver from $17.74 to $17.92 per ounce.

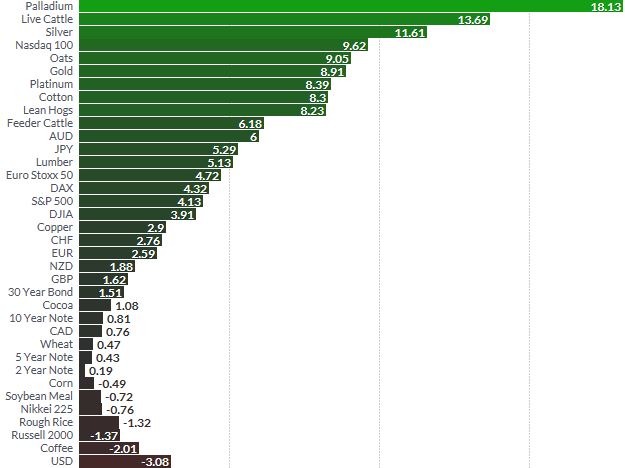

Market Performance 2017 YTD

The precious metals continue to outperform most assets in 2017. Year to date, gold is 9% higher and silver is 11.7% higher. Platinum is 8.4% higher and palladium has surged 18% to two year highs.

Gold and silver have eked out gains as the dollar and stocks have come under pressure after U.S. President Donald Trump failed in his attempts to abolish Obama care. Trump suffered a major political setback on healthcare reform, raising doubts about his ability to steer the economic agenda.

The dollar has fallen to the lowest level in five months and stock markets globally are seeing sharp falls today. Trump's inability to deliver on a major election campaign promise marked a big defeat for a Republican president whose own party controls Congress, and raised doubts whether he would be able to push through tax reforms and mega-spending packages.

Growing U.S. political uncertainty is creating concerns that a recent pick-up in global business and consumer sentiment, particularly in Asia, may be impacted.

Bullion coin and bar demand remains robust. US Mint data shows that strong demand for gold and silver coins continued last week.

Sales of gold coins were the highest since the week ended February 10 and silver coin sales were the highest since the week ending January 20.

As reported by Coin News:

- Gold coins advanced by 13,000 ounces after rising by 8,000 ounces last week. Splits include 9,000 ounces in American Gold Eagles compared to 5,500 ounces previously and 4,000 ounces in American Gold Buffalo compared to 2,500 ounces previously.

- Silver coins jumped by 795,000 ounces compared to 220,000 ounces previously. And like in the last two weeks, American Silver Eagles accounted for all sales.

| US Mint Bullion Sales (# of coins) | ||||||

|---|---|---|---|---|---|---|

| Friday Sales | Last Week | This Week | Feb Sales | Mar Sales | 2017 Sales | |

| $100 American Eagle 1 Oz Platinum Coin | 0 | 0 | 0 | 0 | 0 | 20,000 |

| $50 American Eagle 1 Oz Gold Coin | 0 | 2,500 | 8,500 | 21,000 | 14,500 | 122,000 |

| $25 American Eagle 1/2 Oz Gold Coin | 0 | 1,000 | 0 | 5,000 | 1,000 | 25,000 |

| $10 American Eagle 1/4 Oz Gold Coin | 0 | 2,000 | 0 | 4,000 | 2,000 | 42,000 |

| $5 American Eagle 1/10 Oz Gold Coin | 0 | 20,000 | 5,000 | 30,000 | 35,000 | 190,000 |

| $50 American Buffalo 1 Oz Gold Coin | 0 | 2,500 | 4,000 | 15,000 | 7,000 | 54,000 |

| $1 American Eagle 1 Oz Silver Coin | 0 | 220,000 | 795,000 | 1,215,000 | 1,295,000 | 7,637,500 |

| 2017 Effigy Mounds 5 Oz Silver Coin | 0 | 0 | 0 | 19,500 | 0 | 19,500 |

Speculators became bullish on gold and raised net gold longs last week. Bullion banks, hedge funds and money managers boosted their net long positions in COMEX gold after two weeks of cuts and reduced them slightly in silver in the week to March 21, U.S. Commodity Futures Trading Commission (CFTC) data showed on Friday.

There is now the real risk that Trump becomes a "lame duck" President and that his business friendly policies struggle to be enacted. This bodes badly for stocks and the dollar and well for safe haven gold which should continue to see risk averse flows.

Gold and Silver Bullion - News and Commentary

Gold hits 1-mth high as dollar slides on Trump healthcare failure (Reuters.com)

Shares slide and pound rallies as Trump's healthcare failure rattles markets (TheGuardian.com)

Stocks stumble on U.S. policy woes; Trumpflation trades suffer (Reuters.com)

Gold rallies to a one-month high (FXStreet.com)

Gold, Silver Log Second Week of Gains; US Mint Bullion Sales Jump (CoinNews.net)

[image]https://www.goldcore.com/ie/wp-content/uploads/sites/19/2017/03/greenback-slides-through-200-day-moving-average.png[/image]

These Charts Show Alarm Bells Ringing on the Trump Trade (Bloomberg.com)

Gold Is Back As Dollar’s Reserve Status Questioned (Barrons.com)

“They hate our freedom?” - Paul Craig Roberts (PaulCraigRoberts.org)

Federal Reserve is almost insolvent (ValueWalk.com)

Gold gains altitude, nears 200-DMA (FXStreet.com)

Gold Prices (LBMA AM)

27 Mar: USD 1,256.90, GBP 1,000.49 & EUR 1,157.86 per ounce24 Mar: USD 1,244.00, GBP 996.20 & EUR 1,150.82 per ounce23 Mar: USD 1,247.90, GBP 997.95 & EUR 1,157.93 per ounce22 Mar: USD 1,246.10, GBP 999.50 & EUR 1,154.76 per ounce21 Mar: USD 1,232.05, GBP 989.21 & EUR 1,141.37 per ounce20 Mar: USD 1,233.00, GBP 993.92 & EUR 1,146.57 per ounce17 Mar: USD 1,228.75, GBP 991.85 & EUR 1,140.53 per ounce

Silver Prices (LBMA)

27 Mar: USD 17.94, GBP 14.25 & EUR 16.51 per ounce24 Mar: USD 17.63, GBP 14.11 & EUR 16.31 per ounce23 Mar: USD 17.55, GBP 14.04 & EUR 16.27 per ounce22 Mar: USD 17.58, GBP 14.12 & EUR 16.30 per ounce21 Mar: USD 17.31, GBP 13.88 & EUR 16.01 per ounce20 Mar: USD 17.23, GBP 13.92 & EUR 16.03 per ounce17 Mar: USD 17.40, GBP 14.08 & EUR 16.21 per ounce

Recent Market Updates

- Gold ETFs or Physical Gold? Hidden Dangers In GLD- Gold Prices See Seventh Day Of Gains After Terrorist Attack In London- Peak Gold – Biggest Gold Story Not Being Reported- Silver 1/ 70th The Price of Gold – Silver Eagles Sales Jump- The Best Ways to Invest in Gold Today- Gold Cup – Horse Racing’s Greatest Show, Gambling and ‘Going for Gold’- Gold Up 1.8%, Silver Up 2.6% After Dovish Fed Signals Slow Rate Rises- Most Overvalued Stock Market On Record — Worse Than 1929?- EU Crisis Is Existential – Importance of Tomorrow’s Vote- Digital Gold On Blockchain – For Now Caveat Emptor- Gold $10,000 Coming – “Time To Prepare Is Now”- Silver Very Undervalued from Historical Perpective of Ancient Greece- Gold Investing 101 – Beware Unallocated Gold Accounts With Indebted Bullion Banks and Mints (Part II)

Access Daily and Weekly Updates Here

Interested in learning more about physical gold and silver?Call GoldCore and speak with a gold and silver specialist today