Content originally published at iBankCoin.com

According to Dallas Fed's Kaplan, America has an over abundance of jobs and needs to attract wanton amount of migrants in order to fill the insatiable demand for cheap labor, aka 'skills gap.'

While on one hand, Kaplan ceded to the notion that globalization was a primary reason for price deflation and stagnant growth, he also blamed America's aging demographics for lackluster growth.

"One of the big challenges we face in the United States and one of the reasons why GDP growth has been so sluggish is our population is aging and our workforce growth has been slowing," he said in an interview from the Fed's annual conference in Jackson Hole, Wyoming.

"There's a big skills gap in this country. There's hundreds of thousands if not millions of jobs that employers can't fill, and everywhere I go I hear about this," he said. "We need to grow the workforce if we're going to grow the GDP."

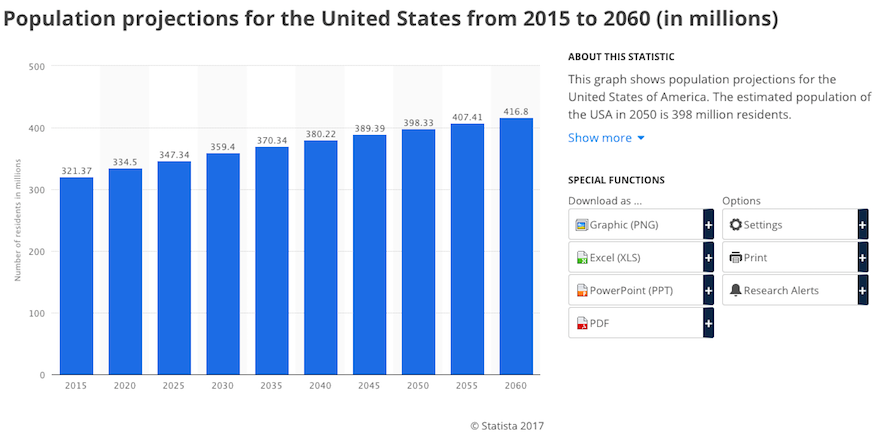

While much of Europe and Japan are beset by aging populations that threaten the very fabric of the burgeoning credit card industry, according to the most recent demographic projections, America is just fine. As a matter of fact, just 15% of our population is over 65 years old and our population should steadily increase for the next 50 years.

Taking a passive-agressive shot at President Trump's immigration ideas, Kaplan reminds us that his parents were immigrants. Ergo, using that logic, we should therefore embrace anyone who'd like to enter the country and take out a credit card loan, or perhaps one designated for students. He's also a big fan of NAFTA.

"Immigrants and their children have made up over half the workforce growth in this country over the last 20 years. They're likely to need to make up more than half in the next 20," Kaplan said. "And one of the key distinctive competencies in the United States is our ability to take people, including my grandparents, assimilate them and make them productive members of society. ... I would be very loathe to see us lose that distinctive competence."

Kaplan also voiced support for international trade agreements, though he agreed with the administration's position that NAFTA should be renegotiated.

"Those trade relationships are essential to U.S. competitiveness and growing U.S. jobs," he said.

It's important to remember that members of the Federal Reserve and the banking industry do not belong to any nation. They're merely cogs in a very big wheel, crunching numbers and wholly interested in seeing banks do well. The social ramifications of too much immigration will never resonate with people like Kaplan, nor do they understand, or care, about who fills construction jobs or other forms of manual labor, as long as America is able to do so in the cheapest way possible. Free trade agreements will always be supported by the Fed, because it enables US corporations to hire very cheap labor in Mexico. That's all that really matters, to men like Kaplan. Your neighborhood and your job is an unimportant statistic and could be replaced by 'innovation' or free trade agreements -- because companies like Apple need to hoard MOAR cash.