The following content is sponsored by the Carbon Streaming Corporation

The Briefing

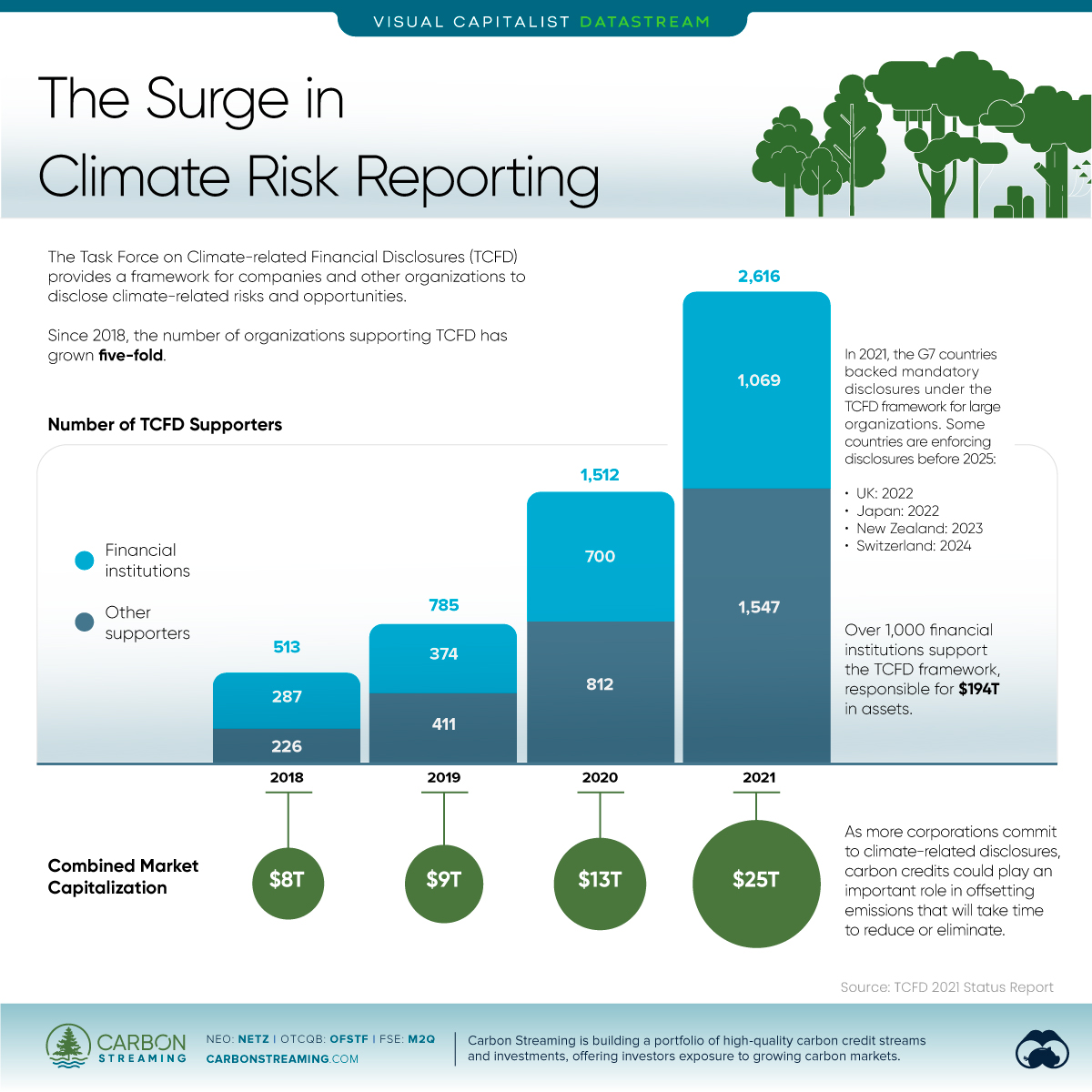

- The Task Force on Climate-related Financial Disclosures (TCFD) provides a global framework for organizations to disclose climate-related risks and opportunities.

- Since 2018, the number of TCFD supporters has grown five-fold.

- Over 1,000 financial institutions support the TCFD, representing $194 trillion in assets.

The Surge in Climate Risk Reporting

An average of $2.5 trillion—or 1.8% of global financial assets—would be at risk from climate change if global temperatures rise over 2.5℃ by 2100.

Given that climate change imposes a risk to the world’s assets, reporting on climate-related risks and opportunities is becoming front and center for organizations amid growing pressure from investors and governments.

The Task Force on Climate-related Financial Disclosures (TCFD), created by the Financial Stability Board (FSB) in 2015, provides a global framework for such disclosures. This graphic sponsored by Carbon Streaming Corporation charts the rapid growth in support for climate risk reporting under the TCFD framework.

The Support for Climate-related Disclosures

The number of organizations supporting TCFD has grown five-fold in just three years, at an average annual rate of 73%.

| Year | Number of TCFD Supporters | Combined Market Capitalization |

|---|---|---|

| 2018 | 513 | $8T |

| 2019 | 785 | $9T |

| 2020 | 1,512 | $13T |

| 2021 | 2,616 | $25T |

As of 2021, over 2,600 organizations supported the TCFD framework, with a combined market capitalization of $25 trillion. These organizations span 89 different countries and jurisdictions, highlighting the global support for climate risk reporting.

Additionally, 1,069 or nearly 41% of these TCFD supporters are financial institutions, responsible for $194 trillion in assets.

| Year | Number of Financial Institutions | Financial Company Assets |

|---|---|---|

| 2018 | 287 | $100T |

| 2019 | 374 | $118T |

| 2020 | 700 | $150T |

| 2021 | 1,069 | $194T |

Furthermore, support for climate-related disclosures will likely continue to grow, especially with the introduction of legislation enforcing them. In 2021, the G7 countries backed introducing mandatory disclosures under the TCFD framework for large organizations and/or certain sectors. Many countries including the UK, Japan, New Zealand and Switzerland are targeting to have mandates in place before 2025.

The Canadian Prime Minister, in his sessional mandate letters to his deputy prime minister and environment and climate change minister, instructed them to move towards mandating climate-related disclosures in line with TCFD in December 2021.

In March 2022, the Securities and Exchange Commission (SEC) in the United States unveiled proposed regulations that would require companies to disclose their greenhouse gas emissions, as well as their exposure to climate-related risks.

In addition, authorities in several regions including the European Union, Brazil, and Singapore have proposed mandatory TCFD disclosures for certain sectors.

Emissions Reporting and the Role of Carbon Credits

Emissions reporting is an important component of the metrics and targets recommended for disclosure under the TCFD framework.

Climate change can pose several risks to companies and can impact how they operate their business and value their assets. Companies that do not disclose this information to investors risk reduced demand for their products or services due to shifting consumer preferences or a reduction in available capital as investors turn to more climate-friendly assets. Investors are seeking more information about the effects of climate-related risks on a company’s business so that they can make informed decisions.

Consequently, companies are facing increased pressure to announce plans to address their emissions, and carbon credits can play an important role as companies work to decarbonize their operations.

By purchasing carbon credits, companies can help fund projects that will reduce emissions today as they implement their plans to reduce or eliminate emissions since this often takes time to execute. Demand for carbon credits has increased over the past few years, with the voluntary carbon markets surpassing $1 billion in value for the first time in 2021.

Carbon Streaming Corporation is focused on acquiring, managing and growing a high-quality and diversified portfolio of investments in projects and/or companies that generate or are actively involved, directly or indirectly, with voluntary and/or compliance carbon credits.

Where does this data come from?

Source: TCFD Status Report, 2021

The post The Surge in Climate Risk Reporting appeared first on Visual Capitalist.