China's Stealth Devaluation Continues Despite Lew Blasting "Unacceptable" FX Practices

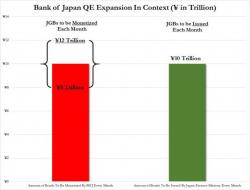

"Intervention in foreign exchange markets in order to gain a competitive advantage is unacceptable," proclaims US Treasury Secretary Jack Lew in a strongly worded statement today with regard America's position in the global economy. That we note this comment is only relevant as, despite the apparent "stability" of the Chinese Yuan against the USD, relative to the 13-currency-basket with which China primarily trades, the Yuan has collapsed to 17-month lows - with JPY and EUR appearing to bear the brunt of the pain.