Faltering Fundamentals Vs "The Fed Won't Let The Market Crash"

Submitted by Lance Roberts via RealInvestmentAdvice.com,

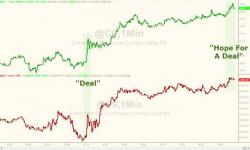

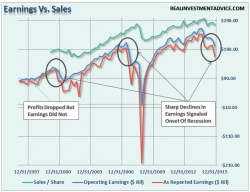

As the trumpets sound to signal the start of earnings season, the battle between fundamentals and “hope” begins. Despite weakening earnings, which on an as reported basis are far worse than the rather manipulated “operating” levels currently suggest, the bulls have remained steadfast in their belief that prices are on a one-way trip higher.