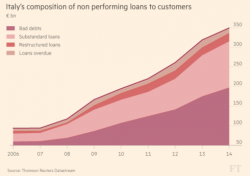

Size Matters: Analysts Mock Italy's Tiny "Atlas" Bailout Fund Meant To Support €360BN In Bad Debt

As we warned all the way back in 2012, European NPL's are a ticking time bomb. Yesterday Italy announced that it had taken the long-anticipated first step to alleviate investor concerns surrounding the stability of the banking system, namely that Italian banks have roughly €360 billion in non-performing loans. Local banks, insurers, and asset managers have agreed to fund a €5 billion backstop for these troubled loans. Speculation of the imminent deal had sent Italian (and European) bank stocks soaring yesterday.