"Ferocious Surprises" Await Bonds Traders In 2016

Submitted by Salil Mehta via Staistical Ideas blog,

Submitted by Salil Mehta via Staistical Ideas blog,

Confirming what we explained here, Goldman Sachs notes that the publication of a new CNY exchange rate index suggests an increased focus on broader CNY moves against other non-USDollar currencies and reinforces the likelihood of further depreciation versus the USD.

Goldman Sachs writes...

Two weeks ago, we predicted that if the same September storm clouds return, and if December, which is increasingly looking as shaky as August as a result of a return of China deval fears, soaring dollar concerns and - the cherry on top - the collapse in junk bonds, forcing the Fed to have some literally last minute concerns about a rate hike, then the Fed's official mouthpiece, Jon Hilsenrath will be very busy...

Yesterday, we highlighted the all too eerie coincidence that the very first hedge fund (not mutual fund) to gate investors late on Friday, was operated by none other than the two former heads of distressed/high yield trading of the bank that started it all, Bear Stearns.

Today, things get even eerier, because while we already have the Bear Stearns link, an even more curious coincidence emerged when according to the BofA-Merrill index of "CCC and below" bond yields, the index just hit 17.24%, soaring nearly 2% in just the past two weeks, and rising fast.

Submitted by David Stockman via The Daily Reckoning blog,

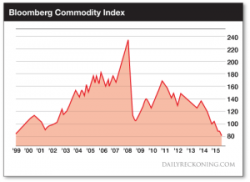

We are nearing a crucial inflection point in the worldwide bubble finance cycle that has been underway for more than two decades. To wit, the world’s central banks have finally run out of dry powder. They will be unable to stop the credit implosion which must inexorably follow the false boom.

We will get to the Fed’s upcoming once in a lifetime shift to raising rates below, but first it is crucial to sketch the global macroeconomic context.