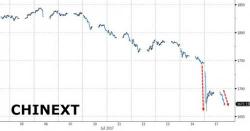

Dollar Tumbles, Euro Soars After Obamacare Repeal Dies; China Intervenes To Halt Rout

Bulletin headline summary from RanSquawk

Bulletin headline summary from RanSquawk

Another new week, another day with not much going on. So much, or rather little so, that in its daily wrap Citi starts off with the following: "Pop Art pioneer Andy Warhol, who once said “I like boring things”, would have been a huge fan of today’s session thus far. Though several events of note linger on the horizon for later this week, G10 is firmly on the beach as of this morning."

Just in case traders haven't gotten whiplash from all the hawkish-to-dovish-to-hawkish shifts in central bank posturing over the past month, here is the WSJ which reports that for the first time in three years, ECB's Mario Draghi is scheduled to address the Fed's Jackson Hole conference in August, "in a speech that is expected to give a further sign of the ECB’s growing confidence in the eurozone economy and its reduced dependence on monetary stimulus."

S&P futures are little changed following yesterday's rout even as Asian and European markets continued selling; the pound slid on poor factory data, the yen tumbled after the BOJ intervened to stabilize the JGB bond market, precious metals flash crashed early in the session, while the selloff in oil accelerated despite yesterday's massive inventory draw, although at least yesterday's sharp bond tantrum has stabilized.

"Probably nothing..."

ECB Minutes spoiled the bond party... when does it become a full blown tantrum...