Euro Tumbles, Bunds Spike On Report ECB "Growing Worried" About Strong Currency

It's time to start worrying about currency wars again.

It's time to start worrying about currency wars again.

Authored by Thorstein Polleit via The Mises Institute,

On 23 August 2017, the president of the European Central Bank (ECB) gave a speech titled “Connecting research and policy making” at the annual assembly of the winners of the Nobel Price for Economics in Lindau, Germany. What Mr Draghi talked about on this occasion — and especially what he didn’t talk about — was quite revealing.

As a reminder, it was in Jackson Hole three years ago that Draghi laid the groundwork for the launch of the ECB's 2.3 trillion-euro asset-purchase program.

They looked pensive before he spoke...

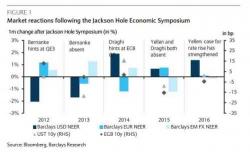

Historically the annual Jackson Hole symposium has been a major market-moving event as it has traditionally been the venue where central banks make critical announcements such as Bernanke's preview and hints of QE2 and QE3 in 2012, as well as Draghi's suggestion of the ECB's QE in 2014. As shown in the chart below, market reactions following these events have been material.

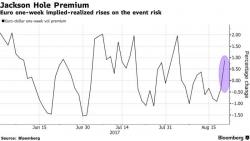

Absent any major geopolitical shocks, it is set to be a quiet summer week ahead with focus on the Jackson Hole conference. On the data front the key releases will be US durable goods and Eurozone PMIs, as well as Japan inflation & UK and Norway GDP. In Emerging Markets, there are monetary policy meetings in Indonesia, Hungary and Kazakhstan.