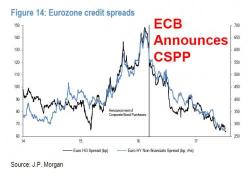

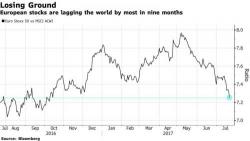

Zombie Corporations Litter Europe, Kept Alive By ECB

Authored by Mike Shedlock via MishTalk.com,

Bank of America says 9% of European firms have subpar interest coverage. Bloomberg covers the story in its report Zombie Companies Littering Europe May Tie the ECB’s Hands for Years.

Watch out for the zombies.