Global Bond Rout Sends S&P Futures, European Stocks Sliding

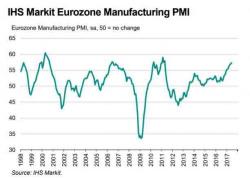

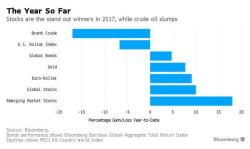

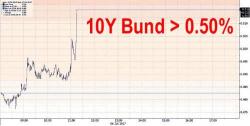

S&P futures are sliding this morning, down 0.4% and tracking the accelerating decline in European and Asian stocks, driven by a move higher in global interest rates, which started with Japanese 10Y yields rising to 0.1% for the first time since February, but mostly Bund yields which spiked after tripping stops, and jumped as high as 0.53% for the first time since early 2016. Oil climbs, dollar and gold slide. Economic data include initial jobless claims, trade balance, Markit PMI readings.