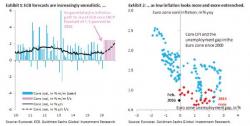

Goldman Gives Draghi An Ultimatum, But The ECB May Be Finally Ready To Snap

The G-20 Shanghai summit was a dud; China's People's Congress fizzled (even if it unleashed the biggest iron ore rally in history, however brief); and so - in a month full of expectations for major policy stimulus (which have so far been vastly disappointing), we approach the one event that is most actionable: the ECB's March 10 meeting and press conference, where expectations are, just like back on December 3, so great - some expect up to a 20 bps rate cut to -0.5%, others expect QE to be increased from €60BN to €70BN per month, yet others believe that Draghi will either extend the TLTRO,