Frontrunning: March 11

- Shares bounce, euro fades after savage ECB reaction (Reuters)

- Trump's Islam comments draw attacks as Republicans discover civility (Reuters)

- IEA Says Oil Price May Have Bottomed as High-Cost Producers Cut (BBG)

- Oil Prices Rise on Hopes Glut Will Ease (WSJ)

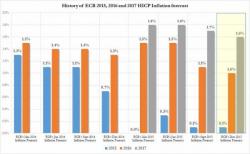

- Why Euro-Area Inflation Will Be Low for Years, According to Draghi (BBG)

- Calmer markets, positive data prime Fed to push ahead with rate rises (Reuters)

- Key powers mulling possibility of federal division of Syria (Reuters)