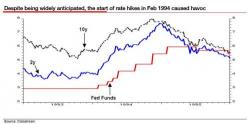

It's 1994 Again: Why Albert Edwards Expects An Imminent "Bond Market Bloodbath"

Following the Trump presidential victory, two prominent macro strategists have undergone a significant change in their outlook: while David Rosenberg, who started off with a deflationary, and bearish outlook, then flipped to inflationary (and bullish), has recently once more "mean-reverted" and expects a further drop in yields as deflationary forces return, his SocGen peer, Albert Edwards - while still expecting a deflationary "ice age" in the longer-run (in case there is any confusion, he expressly states "make no mistake.