Atlanta Fed Slashes Q1 GDP To Only 1.3% With Yellen Set To Hike

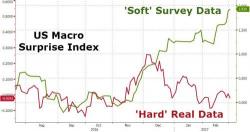

One week ago, we pointed out a curious bifurcation: the Fed was telegraphing an imminent rate hike - one which following Yellen's Friday conference is now virtually assured - even though it appears the FOMC would be hiking in a quarter in which GDP comes in in the mid 1%-range, or lower. The reason: while "soft data" - which is important to animal spirits if not actual economic output - continues to surge, the "hard data", that which actually matters to the economy, is still disappointing.