Written By Jenna Ross

Published May 29, 2023

•

Updated May 27, 2023

•

The following content is sponsored by Citizens Commercial Banking

How Disinflation Could Affect Company Financing

The macroeconomic environment is shifting. Since the second half of 2022, the pace of U.S. inflation has been dropping.

We explore how this disinflation may affect company financing in Part 2 of our Understanding Market Trends series from Citizens.

Disinflation vs. Deflation

The last time inflation climbed above 9% and then dropped was in the early 1980’s.

| Time Period | March 1980-July 1983 | June 2022-April 2023* |

|---|---|---|

| Inflation at Start of Cycle | 14.8% | 9.1% |

| Inflation at End of Cycle | 2.5% | 4.9% |

* The June 2022-April 2023 cycle is ongoing. Source: Federal Reserve. Inflation is based on the Consumer Price Index.

A decrease in the rate of inflation is known as disinflation. It differs from deflation, which is a negative inflation rate like the U.S. experienced at the end of the Global Financial Crisis in 2009.

How might slowing inflation affect the amount of debt and equity available to companies?

Looking to History

There are many factors that influence capital markets, such as technological advances, monetary policy, and regulatory changes.

With this caveat in mind, history signals that both debt and equity issuance expand after a period of disinflation.

Equity Issuance

Companies issued low levels of stock during the ‘80s disinflation period, but issuance later rose nearly 300% in 1983.

| Year | Deal Value |

|---|---|

| 1980 | $2.6B |

| 1981 | $5.0B |

| 1982 | $3.6B |

| 1983 | $13.5B |

| 1984 | $2.5B |

| 1985 | $12.0B |

| 1986 | $24.2B |

| 1987 | $24.9B |

| 1988 | $16.9B |

| 1989 | $12.9B |

| 1990 | $13.4B |

| 1991 | $45.2B |

| 1992 | $50.3B |

| 1993 | $95.3B |

| 1994 | $63.7B |

| 1995 | $79.7B |

| 1996 | $108.7B |

| 1997 | $106.5B |

| 1998 | $97.0B |

| 1999 | $142.8B |

| 2000 | $156.5B |

Source: Bloomberg. U.S. public equity issuance dollar volume that includes both initial and follow-on offerings and excludes convertibles.

Issuance grew quickly in the years that followed. Other factors also influenced issuance, such as the macroeconomic expansion, productivity growth, and the dotcom boom of the ‘90s.

Debt Issuance

Similarly, companies issued low debt during the ‘80s disinflation, but levels began to increase substantially in later years.

| Year | Deal Value | Interest Rate |

|---|---|---|

| 1980 | $4.5B | 11.4% |

| 1981 | $6.7B | 13.9% |

| 1982 | $14.5B | 13.0% |

| 1983 | $8.1B | 11.1% |

| 1984 | $25.7B | 12.5% |

| 1985 | $46.4B | 10.6% |

| 1986 | $47.1B | 7.7% |

| 1987 | $26.4B | 8.4% |

| 1988 | $24.7B | 8.9% |

| 1989 | $29.9B | 8.5% |

| 1990 | $40.2B | 8.6% |

| 1991 | $41.6B | 7.9% |

| 1992 | $50.0B | 7.0% |

| 1993 | $487.8B | 5.9% |

| 1994 | $526.4B | 7.1% |

| 1995 | $632.7B | 6.6% |

| 1996 | $906.0B | 6.4% |

| 1997 | $1.3T | 6.4% |

| 1998 | $1.8T | 5.3% |

| 1999 | $1.8T | 5.7% |

| 2000 | $2.8T | 6.0% |

Source: Dealogic, Federal Reserve. Data reflects U.S. debt issuance dollar volume across several deal types including: Asset Backed Securities, U.S. Agency, Non-U.S. Agency, High Yield, Investment Grade, Government Backed, Mortgage Backed, Medium Term Notes, Covered Bonds, Preferreds, and Supranational. Interest Rate is the 10 Year Treasury Yield.

As interest rates dropped and debt capital markets matured, issuing debt became cheaper and corporations seized this opportunity.

It’s worth noting that debt issuance was also impacted by other factors, like the maturity of the high-yield debt market and growth in non-bank lenders such as hedge funds and pension funds.

Then vs. Now

Could the U.S. see levels of capital financing similar to what happened during the ‘80s disinflation? There are many economic differences between then and now.

Consider how various indicators differed 10 months into each disinflationary period.

| January 1981 | April 2023* | |

|---|---|---|

| Inflation Rate Annual |

11.8% | 4.9% |

| Inflation Expectations Next 12 Months |

9.5% | 4.5% |

| Interest Rate 10-Yr Treasury Yield |

12.6% | 3.7% |

| Unemployment Rate Seasonally Adjusted |

7.5% | 3.4% |

| Nominal Wage Growth Annual, Seasonally Adjusted |

9.3% | 5.0% |

| After-Tax Corporate Profits As Share of Gross Value Added |

9.1% | 13.8% |

* Data for inflation expectations and interest rate is as of May 2023, data for corporate profits is as of Q4 1980 and Q1 2023. Inflation is a year-over-year inflation rate based on the Consumer Price Index. Source: Federal Reserve.

The U.S. economy is in a better position when it comes to factors like inflation, unemployment, and corporate profits. On the other hand, fears of an upcoming recession and turmoil in the banking sector have led to volatility.

What to Consider During Disinflation

Amid uncertainty in financial markets, lenders and investors may be more cautious. Companies will need to be strategic about how they approach capital financing.

- High-quality, profitable companies could be well positioned for IPOs as investors are placing more focus on cash flow.

- High-growth companies could face fewer options as lenders become more selective and could consider alternative forms of equity and private debt.

- Companies with lower credit ratings could find debt more expensive as lenders charge higher rates to account for market volatility.

In uncertain times, it’s critical for businesses to work with the right advisor to find—and take advantage of—financing opportunities.

Learn more about working with Citizens.

Please enable JavaScript in your browser to complete this form.Subscribe to our free newsletter and get your mind blown on a daily basis: *Sign up

Related Topics: #capital markets #citizens #Citizens Bank #disinflation #debt issuance #equity issuance #capital financing #equity #debt #inflation

Click for Comments

var disqus_shortname = "visualcapitalist.disqus.com";

var disqus_title = "How Disinflation Could Affect Company Financing";

var disqus_url = "https://www.visualcapitalist.com/sp/how-disinflation-could-affect-company-financing/";

var disqus_identifier = "visualcapitalist.disqus.com-158230";

You may also like

-

United States2 weeks ago

Charting the Rise of America’s Debt Ceiling

By June 1, a debt ceiling agreement must be finalized. The U.S. could default if politicians fail to act—causing many stark consequences.

-

Wealth2 weeks ago

Ranked: The World’s Top 50 Endowment Funds

Endowment funds represent the investment arms of nonprofits. See the worlds top 50, which collectively have over $1 trillion in assets.

-

Economy3 weeks ago

Visualizing the American Workforce as 100 People

Reimagining all 200 million of the American workforce as 100 people: where do they all work, what positions they hold, and what jobs they do?

-

Central Banks4 weeks ago

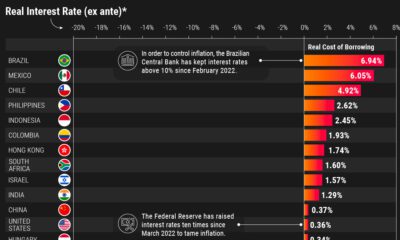

Visualized: Real Interest Rates by Country

What countries have the highest real interest rates? We look at 40 economies to analyze nominal and real rates after projected inflation.

-

Debt2 months ago

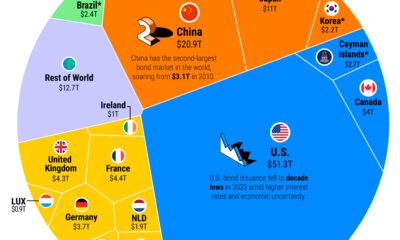

Ranked: The Largest Bond Markets in the World

The global bond market stands at $133 trillion in value. Here are the major players in bond markets worldwide.

-

Markets2 months ago

Visualized: The Largest Trading Partners of the U.S.

Who are the biggest trading partners of the U.S.? This visual showcases the trade balances between the U.S. and its trading partners.

Subscribe

Please enable JavaScript in your browser to complete this form.Join the 380,000+ subscribers who receive our daily email *Sign Up

The post How Disinflation Could Affect Company Financing appeared first on Visual Capitalist.