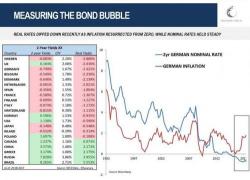

"The Ratio Is Literally Off The Chart": Measuring The Real Bond Bubble

Submitted by Francseco Filia of Fasanara Capital

Measuring the Bond Bubble

A key conviction of ours is that we live through a Twin Bubble in asset markets: an Equity Bubble, particularly in the US, and a Bond Bubble, particularly in Europe.