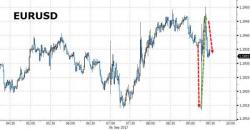

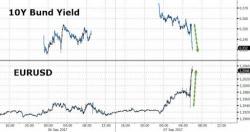

EUR Surges, Bund Yields Tumble As Draghi Sends Conflicting Messages

After a kneejerk move lower in the Euro, tumbling briefly as low as 1.1930 when Mario Draghi made an explicit reference to the strength of the Euro in his prepared remarks, stating that "the recent volatility in the exchange rate represents a source of uncertainty which requires monitoring with regard to its possible implications for the medium-term outlook for price stability", the EURUSD has since surged more than 100 pips, and was up to 1.2050, nearing the 2017 high of 1.2070 during the Q&A part of today's press conference which has been dubbed "pret